13 Mar What Do You Do If Your Business Partner Wants Out?

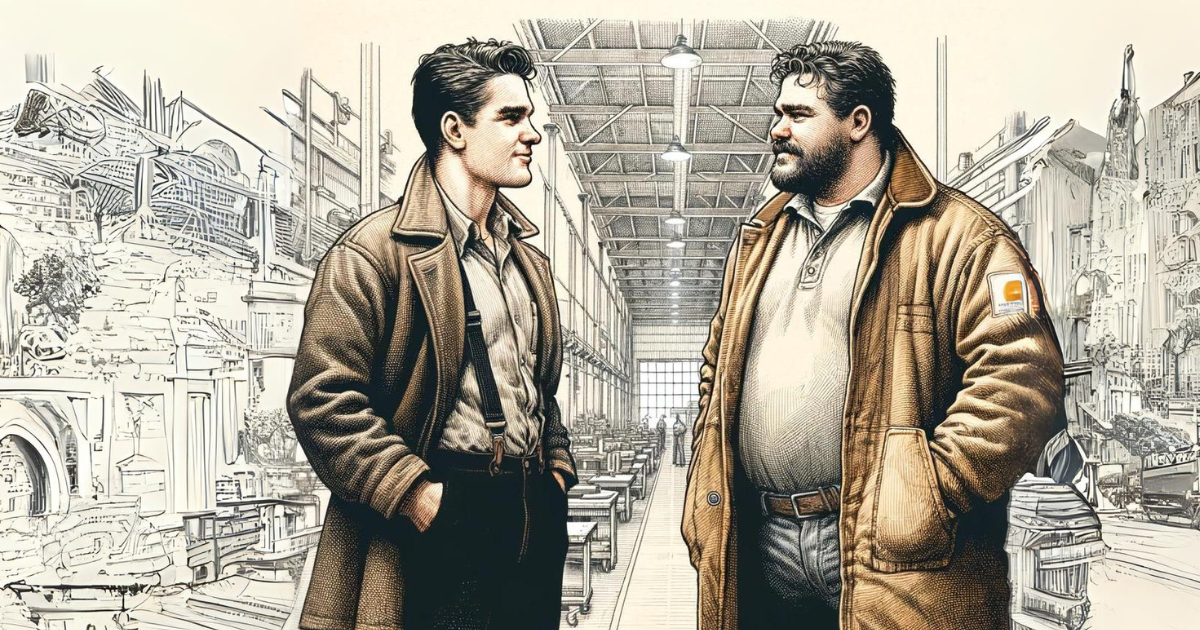

Ted and Jay had spent years building their dream company. They operated a regional manufacturing company specializing in crane parts. When they started, they pooled their savings from their corporate jobs and bought the local family-owned company. Over the next seven years, they each leveraged their significant industry connections and expertise to grow the company to $8.8 million in gross revenue. A bright future laid ahead for the company.

The Unpredictable Happens

But one evening, under the dim lights of their shared office, Ted’s voice broke the silence. With a heaviness that seemed to carry the weight of the world, Ted dropped the news.

“Jay, I need to leave the company.”

Ted’s voice trembled, not just with sorrow but with an urgency that hinted at something more profound than business.

The reason was as unexpected as it was urgent—Ted’s daughter, Emma, had been diagnosed with a rare condition that required immediate and extensive medical treatment, treatments that were not just expensive but would demand Ted’s presence, far away from the business that had consumed their lives. Ted’s decision was not about profit margins or business strategy; it was about a desperate need to be there for his daughter.

Jay, despite the shock and the sudden sense of loss for their shared dreams, understood. Over the ensuing days they had a series of discussions about next steps.

Given their long friendship and successful history in business, Jay and Ted both assumed figuring out a departure plan for Ted would be easy.

They weren’t ready for what lay ahead.

Not So Easy

Jay and Ted had a basic partnership agreement but it did not address what to do in this situation.

“I need to pull out $2 million as soon as possible,” Ted urgently told Jay. Jay struggled to hold back his shock at Ted’s request.

Ted continued, “The rest of my shares can be paid out over the next few months, but the sooner, the better.” Ted believed his remaining shares were worth “around $4 million.”

Jay’s jaw dropped. Where is Ted getting these numbers? How can he expect Jay and the company to come up with that payout? What is Ted entitled to? Are Jay and the company obligated to pay Ted out on these terms?

Their partnership agreement was no help. It had vague language on how to determine what a partner’s shares were worth. The agreement was completely silent on what to do if a partner wanted to leave the company. There was no guidance on how and on what timeframe a partner exit was to happen.

As Jay and Ted got further into the details of Ted’s exit, the conversations shifted from understanding and supportive to tense and confrontational. Ted saw Jay’s resistance to his requests as unsympathetic to his desperate family situation. Jay saw Ted’s increasingly demanding requests as failing to consider Jay and the business’s liquidity constraints.

Jay felt increasingly cornered by Ted’s demands. He began to see Ted’s relentless push for an immediate multi-million-dollar payout and future payouts as a threat to the business’s survival.

Within a few short weeks after Ted’s revelation, heated discussions about Ted’s exit turned their relationship upside down. Ted’s exit threatened to not only derail the company but to permanently fracture Jay and Ted’s longtime friendship.

The Importance of Planning Ahead

It quickly became apparent to Jay and Ted how unprepared they were for this scenario. Their difficulties underscore the vital role of having a legally enforceable plan to address a partner’s exit. This is especially important when the business is family-owned or a partnership made up of close relationships.

The right legal plan for your partnership acts as a safety net, providing a predefined pathway for the transition of ownership under various conditions, including the voluntary departure of a partner.

By setting clear terms for valuation and transfer of the departing partner’s interest, you can ensure that both the business and remaining partners protected. A well-structured plan offers peace of mind to you and your business partners that you’re ready for the unexpected.

Do you have a plan to secure your business’s future? Talk to us to get started: START NOW